(4 pm. – promoted by ek hornbeck)

“Questioning growth is deemed to be the act of lunatics, idealists and revolutionaries. But question it we must.”

“the only thing that has actually remotely slowed down the relentless rise of carbon emissions over the last two to three decades is recession.”

— Tim Jackson

British Economist Tim Jackson studies the links between lifestyle, societal values and the environment to question the primacy of economic growth.

He currently serves as the economics commissioner on the UK government’s Sustainable Development Commission and is director of RESOLVE – a Research group on Lifestyles, Values and Environment. After five years as Senior Researcher at the Stockholm Environment Institute, Jackson became Professor of Sustainable Development at University of Surrey, and was the first person to hold that title at a UK university.

He founded RESOLVE in May 2006 as an inter-disciplinary collaboration across four areas – CES, psychology, sociology and economics – aiming to develop an understanding of the links between lifestyle, societal values and the environment.

In 2009 Jackson published “Prosperity without Growth: Economics for a Finite Planet”, a substantially revised and updated version of Jackson’s controversial study (.PDF, 136 pp.) for the Sustainable Development Commission, an advisory body to the UK Government. The study rapidly became the most downloaded report in the Commission’s nine year history when it was launched in 2009.

Filmed in July at TEDGlobal 2010, here is Tim Jackson’s economic reality check, a 20 minute talk he gave for the TEDGlobal audience…

I want you to imagine a world, in 2050, of around nine billion people, all aspiring to Western incomes, Western lifestyles. And I want to ask the question — and we’ll give them that two percent hike in income, in salary each years as well, because we believe in growth. And I want to ask the question: how far and how fast would be have to move? How clever would we have to be? How much technology would we need in this world to deliver our carbon targets? And here in my chart. On the left-hand side is where we are now. This is the carbon intensity of economic growth in the economy at the moment. It’s around about 770 grams of carbon. In the world I describe to you, we have to be right over here at the right-hand side at six grams of carbon. It’s a 130-fold improvement, and that is 10 times further and faster than anything we’ve ever achieved in industrial history. Maybe we can do it, maybe it’s possible — who knows? Maybe we can even go further and get an economy that pulls carbon out of the atmosphere, which is what we’re going to need to be doing by the end of the century. But shouldn’t we just check first that the economic system that we have is remotely capable of delivering this kind of improvement?

..transcript below..

Transcript:

I want to talk to you today about prosperity, about our hopes for a shared and lasting prosperity. And not just us, but the two billion people worldwide who are still chronically undernourished. And hope actually is at the heart of this. In fact, the Latin word for hope is at the heart of the word prosperity. “Pro-speras,” “speras,” hope — in accordance with our hopes and expectations. The irony is, though, that we have cashed-out prosperity almost literally in terms of money and economic growth. And we’ve grown our economies so much that we now stand in a real danger of undermining hope — running down resources, cutting down rainforests, spilling oil into the Gulf of Mexico, changing the climate — and the only thing that has actually remotely slowed down the relentless rise of carbon emissions over the last two to three decades is recession. And recession, of course, isn’t exactly a recipe for hope either, as we’re busy finding out. So we’re caught in a kind of trap. It’s a dilemma, a dilemma of growth. We can’t live with it; we can’t live without it. Trash the system or crash the planet. It’s a tough choice. It isn’t much of a choice. And our best avenue of escape from this actually is a kind of blind faith in our own cleverness and technology and efficiency and doing things more efficiently. Now I haven’t got anything against efficiency. And I think we are a clever species sometimes. But I think we should also just check the numbers, take a reality check here.

So I want you to imagine a world, in 2050, of around nine billion people, all aspiring to Western incomes, Western lifestyles. And I want to ask the question — and we’ll give them that two percent hike in income, in salary each years as well, because we believe in growth. And I want to ask the question: how far and how fast would be have to move? How clever would we have to be? How much technology would we need in this world to deliver our carbon targets? And here in my chart. On the left-hand side is where we are now. This is the carbon intensity of economic growth in the economy at the moment. It’s around about 770 grams of carbon. In the world I describe to you, we have to be right over here at the right-hand side at six grams of carbon. It’s a 130-fold improvement, and that is 10 times further and faster than anything we’ve ever achieved in industrial history. Maybe we can do it, maybe it’s possible — who knows? Maybe we can even go further and get an economy that pulls carbon out of the atmosphere, which is what we’re going to need to be doing by the end of the century. But shouldn’t we just check first that the economic system that we have is remotely capable of delivering this kind of improvement?

So I want to just spend a couple of minutes on system dynamics. It’s a bit complex, and I apologize for that. What I’ll try and do, is I’ll try and paraphrase it is sort of human terms. So it looks a little bit like this. Firms produce goods for households — that’s us — and provide us with incomes, and that’s even better, because we can spend those incomes on more goods and services. That’s called the circular flow of the economy. It looks harmless enough. I just want to highlight one key feature of this system, which is the role of investment. Now investment constitutes only about a fifth of the national income in most modern economies, but it plays an absolutely vital role. And what it does essentially is to stimulate further consumption growth. It does this in a couple of ways — chasing productivity, which drives down prices and encourages us to buy more stuff. But I want to concentrate on the role of investment in seeking out novelty, the production and consumption of novelty. Joseph Schumpeter called this “the process of creative destruction.” It’s a process of the production and reproduction of novelty, continually chasing expanding consumer markets, consumer goods, new consumer goods.

And this, this is where it gets interesting, because it turns out that human beings have something of an appetite for novelty. We love new stuff — new material stuff for sure — but also new ideas, new adventures, new experiences. But the materiality matters too. Because, in every society that anthropologists have looked at, material stuff operates as a kind of language, a language of goods, a symbolic language that we use to tell each other stories — stories, for example, about how important we are. Status-driven, conspicuous consumption thrives from the language of novelty. And here, all of a sudden, we have a system that is locking economic structure with social logic — the economic institutions, and who we are as people, locked together to drive an engine of growth. And this engine is not just economic value; it is pulling material resources relentlessly through the system, driven by our own insatiable appetites, driven in fact by a sense of anxiety. Adam Smith, 200 years ago, spoke about our desire for a life without shame. A life without shame: in his day, what that meant was linen shirts, and today, well, you still need the shirt, but you need the hybrid car, the HDTV, two holidays a year in the sun, the netbook and iPad, the list goes on — an almost inexhaustible supply of goods, driven by this anxiety. And even if we don’t want them, we need to buy them, because, if we don’t buy them, the system crashes. And to stop it crashing over the last two to three decades, we’ve expanded the money supply, expanded credit and debt, so that people can keep buying stuff. And of course, that expansion was deeply implicated in the crisis.

But this — I just want to show you some data here. This is what it looks like, essentially, this credit and debt system, just for the U.K. This was the last 15 years before the crash. And you can see there, consumer debt rose dramatically. It was above the GDP for three years in a row just before the crisis. And in the mean time, personal savings absolutely plummeted. The savings ratio, net savings, were below zero in the middle of 2008, just before the crash. This is people expanding debt, drawing down their savings, just to stay in the game. This is a strange, rather perverse, story, just to put it in very simple terms. It’s a story about us, people, being persuaded to spend money we don’t have on things we don’t need to create impressions that won’t last on people we don’t care about.

(Laughter)

(Applause)

But before we consign ourselves to despair, maybe we should just go back and say, “Did we get this right? Is this really how people are? Is this really how economists behave?” And almost straightaway we actually run up against a couple of anomalies. The first one is in the crisis itself. In the crisis, in the recession, what do people want to do? They want to hunker down. They want to look to the future. They want to spend less and save more. But saving is exactly the wrong thing to do from the system point of view. Keynes called this the “paradox of thrift” — saving slows down recovery. And politicians call on us continually to draw down more debt, to draw down our own savings even farther, just so that we can get the show back on the road, so we can keep this growth-based economy going. It’s an anomaly, it’s a place where the system actually is at odds with who we are as people.

Here’s another one — completely different one: Why is it that we don’t do the blindingly obvious things we should do to combat climate change, very, very simple things like buying energy-efficient appliances, putting in efficient lights, turning the lights off occasionally, insulating our homes? These things save carbon, they save energy, they save us money. So is it that, though they make perfect economic sense, we don’t do them? Well, I had my own personal insight into this a few years ago. It was a Sunday evening, Sunday afternoon, and it was just after — actually, to be honest, too long after — we had moved into a new house. And I had finally got around to doing some draft stripping, installing insulation around the windows and doors to keep out the drafts. And my, then, five year-old daughter was helping me in the way that five year-olds do. And we’d been doing this for a while, when she turned to me very solemnly and said, “Will this really keep out the giraffes?” (Laughter) “Here they are, the giraffes.” You can hear the five-year-old mind working. These ones, interestingly, are 400 miles north of here outside Barrow-in-Furness in Cumbria. Goodness knows what they make of the Lake District weather. But actually that childish misrepresentation stuck with me, because it suddenly became clear to me why we don’t do the blindingly obvious things. We’re too busy keeping out the giraffes — putting the kids on the bus in the morning, getting ourselves to work on time, surviving email overload and shop floor politics, foraging for groceries, throwing together meals, escaping for a couple of precious hours in the evening into prime-time TV or TED online, getting from one end of the day to the other, keeping out the giraffes.

(Laughter)

What is the objective? “What is the objective of the consumer?” Mary Douglas asked in an essay on poverty written 35 years ago. “It is,” she said, “to help create the social world and find a credible place in it.” That is a deeply humanizing vision of our lives, and it’s a completely different vision than the one that lies at the heart of this economic model. So who are we? Who are these people? Are we these novelty-seeking, hedonistic, selfish individuals? Or might we actually occasionally be something like the selfless altruist depicted in Rembrandt’s lovely, lovely sketch here? Well psychology actually says there is a tension, a tension between self-regarding behaviors and other regarding behaviors. And these tensions have deep evolutionary roots. So selfish behavior is adaptive in certain circumstances — fight or flight.

But other regarding behaviors are essential to our evolution as social beings. And perhaps even more interesting from our point of view, another tension between novelty-seeking behaviors and tradition or conservation. Novelty is adaptive when things are changing and you need to adapt yourself. Tradition is essential to lay down the stability to raise families and form cohesive social groups. So here, all of a sudden, we’re looking at a map of the human heart. And it reveals to us, suddenly, the crux of the matter. What we’ve done is we’ve created economies. We’ve created systems, which systematically privilege, encourage, one narrow quadrant of the human soul and left the others unregarded. And in the same token, the solution becomes clear, because this isn’t, therefore, about changing human nature. It isn’t, in fact, about curtailing possibilities. It is about opening up. It is about allowing ourselves the freedom to become fully human, recognizing the debt and the breadth of the human psyche and building institutions to protect Rembrandt’s fragile altruist within.

What does all this mean for economics? What would economies look like if we took that vision of human nature at their heart and stretched them along these orthogonal dimensions of the human psyche? Well, it might look a little bit like the 4,000 community-interest companies that have sprung up in the U.K. over the last five years and a similar rise in B corporations in the United States, enterprises that have ecological and social goals written into their constitution at their heart, companies, in fact, like this one, Ecosia. And I just want to, very quickly, show you this. Ecosia is an Internet search engine. Internet search engines work by drawing revenues from sponsored links that appear when you do a search. And Ecosia works in pretty much the same way. So we can do that here. We can just put in a little search term. There you go, Oxford, that’s where we are. See what comes up. The difference with Ecosia though is that, in Ecosia’s case, it draws the revenues in the same way, but it allocates 80 percent of those revenues to a rainforest protection project in the Amazon. And we’re going to do it. We’re just going to click on Naturejobs.uk. In case anyone out there is looking for a job in a recession, that’s the page to go to. And what happened then was the sponsor gave revenues to Ecosia, and Ecosia is giving 80 percent of those revenues to a rainforest protection project. It’s taking profits from one place and allocating them into the protection of ecological resources.

It’s a different kind of enterprise for a new economy. It’s a form, if you like, of ecological altruism — perhaps something along those lines. Maybe it’s that. Whatever it is, whatever this new economy is, what we need the economy to do, in fact, is to put investment back into the heart of the model, to re-conceive investment. Only now, investment isn’t going to be about the relentless and mindless pursuit of consumption growth. Investment has to be a different beast. Investment has to be, in the new economy, protecting and nurturing the ecological assets on which our future depends. It has to be about transition. It has to be investing in low-carbon technologies and infrastructures. We have to invest, in fact, in the idea of a meaningful prosperity, providing capabilities for people to flourish.

And of course, this task has material dimensions. It would be nonsense to talk about people flourishing if they didn’t have food, clothing and shelter. But it’s also clear that prosperity goes beyond this. It has social and psychological aims — family, friendship, commitments, society, participating in the life of that society. And this too requires investment, investment, for example, in places, places where we can connect, places where we can participate, shared spaces, concert halls, gardens, public parks, libraries, museums, quiet centers, places of joy and celebration, places of tranquility and contemplation, sites for the “cultivation of a common citizenship” in Michael Sandel’s lovely phrase. An investment — investment, after all, is just such a basic economic concept — is nothing more nor less than a relationship between the present and the future, a shared present and a common future. And we need that relationship to reflect, to reclaim hope.

So let me come back, with this sense of hope, to the two billion people still trying to live each day on less than the price of a skinny latte from the cafe next door. What can we offer those people? It’s clear that we have a responsibility to help lift them out of poverty. It’s clear that we have a responsibility to make room for growth where growth really matters in those poorest nations. And it’s also clear that we will never achieve that unless we’re capable of redefining a meaningful sense of prosperity in the richer nations, a prosperity that is more meaningful and less materialistic than the growth-based model. So this is not just a Western post-materialist fantasy. In fact, an African philosopher wrote to me, when “Prosperity Without Growth” was published, pointing out the similarities between this view of prosperity and the traditional African concept of ubuntu. Ubuntu says, “I am because we are.” Prosperity is a shared endeavor. Its roots are long and deep. Its foundations, I’ve tried to show, exist already, inside each of us. So this is not about standing in the way of development. It’s not about overthrowing capitalism. It’s not about trying to change human nature. What we’re doing here is we’re taking a few simple steps towards an economics fit for purpose. And at the heart of that economics, we’re placing a more credible, more robust, and more realistic vision of what it means to be human.

Thank you very much.

(Applause)

Chris Anderson: While they’re taking the podium away, just a quick question. First of all, economists aren’t supposed to be inspiring, so you may need to work on the tone a little. (Laughter) Can you picture the politicians every buying into this? I mean, can you picture a politician standing up in Britain and saying, “GDP fell two percent this year. Good news! We’re actually all happier, and a country’s more beautiful, and our lives are better.”

Tim Jackson: Well that’s clearly not what you’re doing. You’re not making new out of things falling down. You’re making news out of the things that tell you that we’re flourishing. Can I picture politicians doing it? Actually, I already am seeing a little bit of it. When we first started this kind of work, politicians would stand up, treasury spokesmen would stand up, and accuse us of wanting to go back and live in caves. And actually in the period through which we’ve been working over the last 18 years — partly because of the financial crisis and a little bit of humility in the profession of economics — actually people are engaging in this issue in all sorts of countries around the world.

CA: But is it mainly politicians who are going to have to get their act together, or is it going to be more just civil society and companies?

TJ: It has to be companies. It has to be civil society. But it has to have political leadership. This is a kind of agenda, which actually politicians themselves are kind of caught in that dilemma, because they’re hooked on the growth model themselves. But actually opening up the space to think about different ways of governing, different kinds of politics, and creating the space for civil society and businesses to operate differently — absolutely vital.

CA: And if someone could convince you that we actually can make the — what was it? — the 130-fold improvement in efficiency, of reduction of carbon footprint, would you then actually like that picture of economic growth into more knowledge-based goods?

TJ: I would still want to know that you could do that and get below zero by the end of the century, in terms of taking carbon out of the atmosphere, and solve the problem of biodiversity and reduce the impact on land use and do something about the erosion of topsoils and the quality of water. If you can convince me we can do all that, then, yes, I would take the two percent.

CA: Tim, thank you for a very important talk. Thank you.

(Applause)

On May 16, 2009 a collaboration between the British medical journal The Lancet and University College London released the first UCL Lancet Commission report, assessing the impact of global warming on global health, and on populations.

Titled Managing the health effects of climate change (.PDF), the year long study highlights the threat of climate change on patterns of disease, water and food insecurity, human settlements, extreme climatic events, and population migration. The report also highlights the action required by global society to mitigate the health impacts of climate change.

“Climate change,” the report concludes, “is the biggest global health threat of the 21 century.”

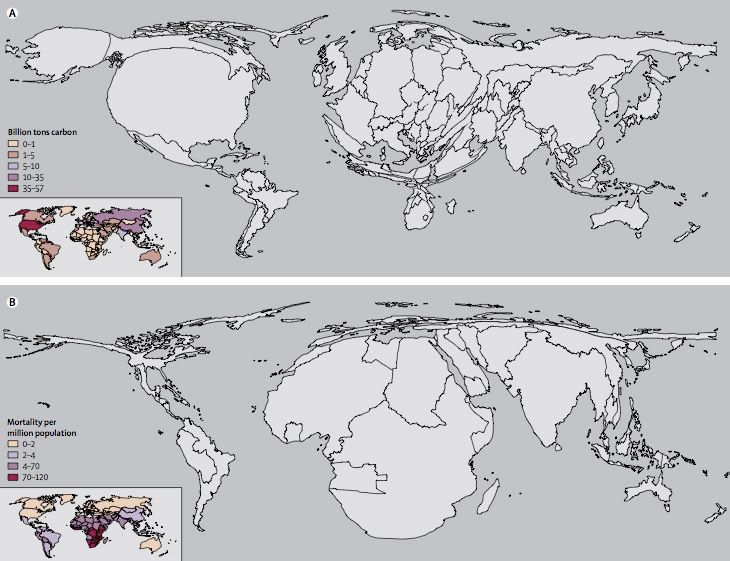

The report presents the two distorted maps shown below – density equalizing cartograms depicting a comparison of undepleted CO2 emissions by country for 1950-2000 versus the regional distribution of four climate sensitive health consequences (malaria, malnutrition, diarrhea, and inland flood-related fatalities).

expand image

The first image shows the world in terms of carbon emissions. America, for instance, is huge. So is China. And Europe. Africa is hardly visible.

The second map shows the world in terms of increased mortality — that is to say, deaths — from climate change. Suddenly, America virtually disappears. So does Europe. Africa, however, is grotesquely distended. South Asia inflates.

In Barack Obama’s commencement address Sunday May 17, 2009 at the University of Notre Dame in South Bend, Indiana, Obama exhorted the graduates to recognize that “that our fates are tied up, as Dr. King said, in a ‘single garment of destiny.'” and “Your generation must decide how to save God’s creation from a changing climate that threatens to destroy it.”

But the peoples of the world are not bound equally.

“Loss of healthy life years as a result of global environmental change (including climate change) is predicted to be 500 times greater in poor African populations than in European populations,” states the UCL Lancet Commission report bluntly.

4 comments

Skip to comment form

Author

what the bigoted right wing response to that will be?

Dick Chehey is smiling somewhere in his undisclosed location right now because all but one of the Republican wing nut running for office are climate change deniers.

In Climate Denial, Again