Monday Business Edition

It’s slowly starting to dawn on Institutional Democrats that they’re going to lose big in November. The consequences are very real. Racist Radical Reagan Republicanism is a proven failure. And Institutional Democrats? They’re a failure too because they knew what to do and didn’t do it.

I’ll put my policy prescription right up front, the only thing that will save Democrats at this point is massive downsizing- Rahm Emanuel, David Axelrod, Gibbs, Geithner and Summers, Salazar and Duncan. Do I want heads on pikes? Figuratively, yes. These highly paid strikeout kings and clubhouse malcontents have to go for the good of the team.

And if not I hope you’re happy with the crappy offices that come with minority status and one term Presidencies you corporatist whores. Anyone who claims to care about “electoral victory” is a liar.

It’s Witch-Hunt Season

By PAUL KRUGMAN, The New York Times

Published: August 29, 2010

So what will happen if, as expected, Republicans win control of the House? We already know part of the answer: Politico reports that they’re gearing up for a repeat performance of the 1990s, with a “wave of committee investigations” – several of them over supposed scandals that we already know are completely phony. We can expect the G.O.P. to play chicken over the federal budget, too; I’d put even odds on a 1995-type government shutdown sometime over the next couple of years.

It will be an ugly scene, and it will be dangerous, too. The 1990s were a time of peace and prosperity; this is a time of neither. In particular, we’re still suffering the after-effects of the worst economic crisis since the 1930s, and we can’t afford to have a federal government paralyzed by an opposition with no interest in helping the president govern. But that’s what we’re likely to get.

If I were President Obama, I’d be doing all I could to head off this prospect, offering some major new initiatives on the economic front in particular, if only to shake up the political dynamic. But my guess is that the president will continue to play it safe, all the way into catastrophe.

Opposition Pay-offs

by Dave Anderson, 2010 August 29

The stimulus as passed in ARRA was necessary but insufficient. It was too small at the topline number for the size of the output gap we actually faced (as the recession was deeper than the earlier data showed) and poorly designed with too much money going to AMT fixes and ineffective lump-sum tax-cuts. The effective parts were pared back to please Sens. Collins, Snowe and Nelson. And this was because the Republican Party realized they were the opposition and the job of the opposition is to oppose. It also was because the Obama Administration likes to punch dirty fucking hippies, especially when they are right on the math and the political outcomes.

What Can Obama Really Do?

by Ian Welsh, 2010 August 29

The idea that Obama, or any President, is a powerless shrinking violet, helpless in the face of Congress is just an excuse. Presidents have immense amounts of power: the question is whether or not they use that power, and if they do, what they use it for.

…

If Obama is not using that money and authority, the bottom line is it’s because he doesn’t want to.

Putting aside the question of what Obama could have accomplished already, if he wants to help everyday Americans, turn around Democratic approval ratings in time for the midterm elections, and leave behind him a legacy of achievement, he can still do it. If he wants to.

The Two Stories of This Terrible Economy, Yet Obama and the Dems Won’t Tell Theirs

Robert Reich, Friday, August 27, 2010

If Obama and the Democrats would connect these dots they’d have a story that would make Americans’ hair stand on end. We’re in this mess because of big business and Wall Street. Government is needed to get us out of it.

…

So why haven’t Obama and the Dems succeeded yet? Big business and Wall Street have used their money and political clout to stop government from doing as much as needs to be done.

The story is clear, and it has the virtue of being the truth. Why won’t Obama and the Democrats tell it? Is it because big business and Wall Street have the money and political clout even to prevent the story from being told?

Policy Options Dwindle as Economic Fears Grow

By PETER S. GOODMAN, The New York Times

Published: August 28, 2010

“There are many ways in which you can see us almost surely being in a Japan-style malaise,” said the Nobel-laureate economist Joseph Stiglitz, who has accused the Obama administration of underestimating the dangers weighing on the economy. “It’s just really hard to see what will bring us out.”

Japan’s years of pain were made worse by deflation – falling prices – an affliction that assailed the United States during the Great Depression and may be gathering force again. While falling prices can be good news for people in need of cars, housing and other wares, a sustained, broad drop discourages businesses from investing and hiring. Less work and lower wages translates into less spending power, which reinforces a predilection against hiring and investing – a downward spiral.

Deflation is both symptom and cause of an economy whose basic functioning has stalled. It reflects too many goods and services in the marketplace with not enough people able to buy them.

Banks’ Self-Dealing Super-Charged Financial Crisis

by Jake Bernstein and Jesse Eisinger, ProPublica

Aug. 26, 10:09 p.m.

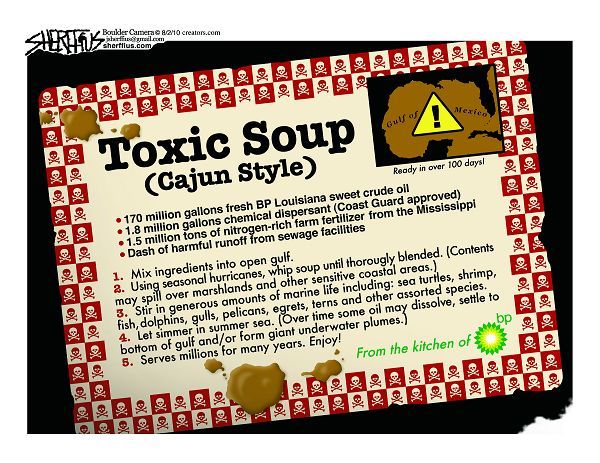

Over the last two years of the housing bubble, Wall Street bankers perpetrated one of the greatest episodes of self-dealing in financial history.

Faced with increasing difficulty in selling the mortgage-backed securities that had been among their most lucrative products, the banks hit on a solution that preserved their quarterly earnings and huge bonuses:

They created fake demand.

More Business News below.

Recent Comments