Just before the last round of presidential elections in Egypt that put Muslim Brotherhood candidate Mohamed Morsi in office, the Egyptian Supreme Constitutional Court, which is still packed with the Mubarak regimes appointees, ruled that the parliamentary elections were invalid. The ruling military then dissolved the lower house until new elections could he held. Sunday, in defiance of the ruling, President Morsi decreed the the old parliament to reconvene until a new parliament was elected:

Just before the last round of presidential elections in Egypt that put Muslim Brotherhood candidate Mohamed Morsi in office, the Egyptian Supreme Constitutional Court, which is still packed with the Mubarak regimes appointees, ruled that the parliamentary elections were invalid. The ruling military then dissolved the lower house until new elections could he held. Sunday, in defiance of the ruling, President Morsi decreed the the old parliament to reconvene until a new parliament was elected:

The move was the first in a series of decrees planned by Morsi against the military, according to Morsi’s former campaign media coordinator Sameh El-Essawy, a member of the Muslim Brotherhood’s Freedom and Justice Party. [..]

And hints of a deal seemed unlikely after Morsi’s decree, which stipulated that parliament reconvene and continue its duties until a new assembly is elected, scheduled for 60 days after Egypt drafts a new constitution. Morsi’s decree directly contradicts Scaf’s wishes, and underlines his determination to take control of the country’s executive.

Morsi’s decree is a reversal of the Scaf decision to dissolve parliament, not the SCC ruling that deemed it invalid, said El-Essawy. “He reversed the Scaf decision, using the same executive powers they had. He has not reversed the court ruling which he respects and that’s why a new parliament will be elected after the constitution,” he said.

The Egyptian Parliament reconvened for five minutes on Tuesday for just one vote:

The parliamentary speaker, Saad el-Katatny, convened a session of the lower house on Tuesday morning but it lasted only five minutes, during which time he stressed that parliament had the utmost respect for the law, and would do nothing to subvert it. MPs then voted that parliament would refer the matter of its ability to convene to the court of cassation in Cairo, and would not assemble until a judgment had been given.

As the drama was being played out, demonstrators against the dissolution of parliament gathered in Tahrir Square. Meanwhile, anti-parliament protesters congregated on the other side of town in the eastern district of Nasr City to voice their objection to its return.

Tuesday’s assembly was boycotted by a sizable number of liberal MPs while an independent MP, Mustafa Bakri, had already announced his formal resignation from parliament due to its unconstitutionality.

Then just hours after the chamber’s brief session, the Supreme Constitutional Court stepped in

“The Supreme Court has once again reiterated that the parliament is dissolved,” our correspondent said. “It’s the third decsion by them saying that Morsi’s decison to reinstate the parliament was illegal. They cannot say it in any more certain terms than that.”

“They’re saying that the parliament sessions cannot continue, which would mean legislative powers would stay in the hands of the armed forces – in this power struggle between the military and the president.” [..]

Lawyers representing Morsi criticised the court’s latest decision and said Tuesday’s ruling was a political move that would further complicate the crisis.

“This ruling is null and void,” lawyer Abdel Moneim Abdel Maqsud told reporters while another member of the team, Mamduh Ismail, called it a “political decision”. [..]

Morsi’s decree was hailed by those who want to see the army return to barracks, but it was criticised by those who fear an Islamist monopolisation of power as a “constitutional coup”.

As noted in an editorial in the Los Angeles Times, this is just the first of many confrontations between Morsi and the military:

In reconvening the People’s Assembly, Morsi insisted that he wasn’t flouting the decision of the court but rather reversing an executive action taken by the military council in the absence of a civilian president. Indeed, the overarching issue in this dispute is whether the armed forces are prepared to yield power to the elected representatives of the Egyptian people. [..]

To some extent, the military’s power – along with economic realities – may have inclined Morsi and the Muslim Brotherhood to a more pluralist and moderate course. But if the generals overplay their hand, they will lose popular support and antagonize Egypt’s allies, including the United States, which provides the military with $1.3 billion a year in assistance. Both Congress and the Obama administration have put the generals on notice that those funds are in jeopardy if the transition to democracy is thwarted. An attempt to shut down a reconvened parliament would be interpreted inside and outside Egypt as just such an obstruction.

So far, the Mohamed Morsi 0 – Egyptian Military 1.

The heads of state of the EuroZone countries met in Brussels today for a two day summit to try to come to an agreement on

The heads of state of the EuroZone countries met in Brussels today for a two day summit to try to come to an agreement on  The Greeks have decided to stay the course with the center right and have given a

The Greeks have decided to stay the course with the center right and have given a  In France, exit polls indicate that

In France, exit polls indicate that  There are no results yet for Egypt. But there is news and it is not good for the Egyptian people no matter who wins.

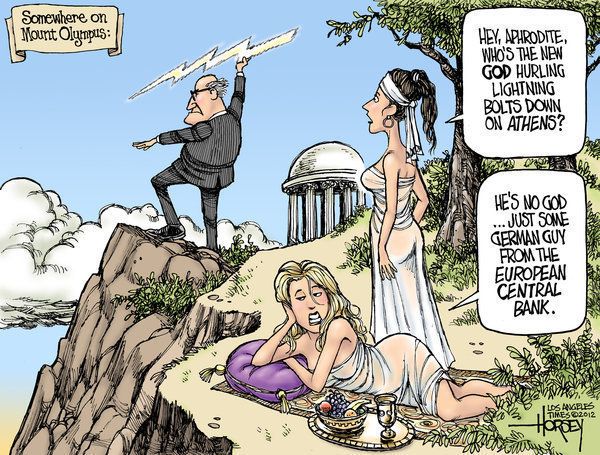

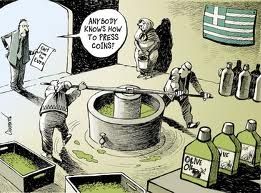

There are no results yet for Egypt. But there is news and it is not good for the Egyptian people no matter who wins.  The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting. Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Recent Comments