The Great Recession of 2007-2009 triggered the Depression that we appear to be exiting this summer. And it was triggered by the collapse of the Great Turn of the Century Suburban Housing Bubble.

The Great Recession of 2007-2009 triggered the Depression that we appear to be exiting this summer. And it was triggered by the collapse of the Great Turn of the Century Suburban Housing Bubble.

In coming out of the recent Depression, one driver of residential property values, the Cul de Sac, seems to be in conflict with a new driver: walkability. In October 2013, the Realtor(R) Magazine Online, of the National Association of Realtors, wrote, in Neighborhoods: More Walkable, More Desirable that:

Neighborhoods that boast greater walkability tend to have higher resale values in both residential and commercial properties, finds a recent study published in Real Estate Economics. In fact, a 2009 report by CEOs for Cities found that just a one-point increase in a city’s walk score could potentially increase homes’ values by $700 to $3,000.

And Ken Harney, writing for NewHomeSource.com, observes in that:

The core concept – connecting people with where they want to work, play and own a home by creating attractive neighborhood environments that make maximum use of existing transit infrastructure – fits many post-recession households’ needs, regardless of age. Older owners of suburban homes are downsizing into townhouses and condo units close to or in the central city, often in locations near transit lines. Younger buyers, fed up with long commutes to work, want to move to places where they can jump onto mass transit and get off the road.

Many of these buyers also have an eye on economics. For example, Bill Locke, a federal contracts consultant in northern Virginia, said that although owning a LEED-certified townhome near a Metro transit stop “is a really big deal” for himself and his wife, he sees the unit they recently purchased in the Old Town Commons development in Alexandria, Va., as a long-term investment that will grow in value “because it makes so much more sense” than competing, traditional subdivisions farther out from the city.

So, what does this mean for the sustainable transport and for the future of the deadly American Suburban Cul de Sac? Let’s have a chat about it, below the fold.

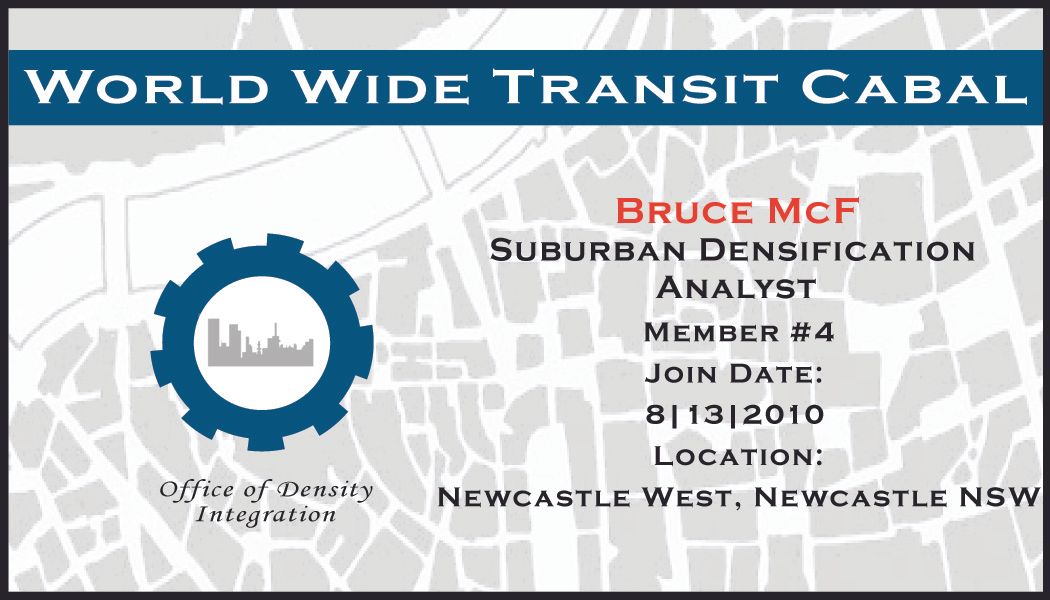

As a member of the WorldWide Transit Cabal (not to be confused with the

As a member of the WorldWide Transit Cabal (not to be confused with the

Recent Comments