The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

William K. Black, an associate professor of economics and law at the University of Missouri-Kansas City, former litigation director for the Federal Home Loan Bank Board and a white-collar criminologist, takes reporters at the New York Times task for their profound ignorance on covering Europe’s financial, social, and political crises. He explains why they are so wrong:

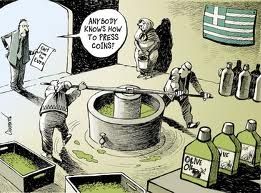

Economists have known for roughly 75 years that adopting austerity in response to recession or depression will make the economic crisis grow and last far longer. Austerity is to economics as bleeding was to medicine. [..]

The NYT article focuses on Alexis Tsipras, the Greek political leader whose party rose to prominence by promising to reject the loan-for-austerity program that the disgraced former Greek government agreed to at Berlin’s diktat. The article’s theme is that Tsipras is endangering all of Europe by demanding an end to austerity being imposed on Greece. The reporters write, as if it were undisputed fact, that Tsipras has started “a high-stakes game of chicken with Europe’s leaders.” But that reverses the facts.

The game that Berlin designed required the Greek to agree (1) to drive their economy off a cliff into a deepening Great Depression through increased austerity, (2) to force an enormous reduction in working class wages, (3) to sell Greek islands to private parties, and (4) to give up other aspects of sovereignty so that hostile, foreign, and private entities such as the IMF and the ECB could monitor its governmental actions. The Greeks are now refusing to commit economic, political, and social suicide. The Germans are demanding that they drive off the cliff because “a deal is a deal.”

If Greece were to drive off the cliff by adopting greater austerity it would likely destroy the EU. Austerity would force Greece into a deepening depression, eventually lead to a default on Greek sovereign debt, and tear Greece apart. Austerity has already generated a substantial neo-Nazi party in Greece. Few Americans recall the Greek civil war between the right and the left that began in World War II and continued for several years after the war or the post-war coup. Greeks recall the civil war and the coup and fear their resumption. Proponents of the Berlin Consensus already have blood on their hands because of the suicides engendered by mass unemployment, small business failures, and hopelessness. If the Berlin Consensus sparks a civil war or coup it could be fatal to the EU.

The EU crisis was also the topic of a heady discussion on this Sunday’s Up with Chris Hayes. Prof. Black was joined on the “Uppers” panel by Betsey Stevenson, former chief economist for the Obama Labor Department, Karl Smith, assistant professor of economics and government at the University of North Carolina at Chapel Hill; and MSNBC policy analyst Ezra Klein.

Eurozone in fragile balance

Mr Hayes’ assessment of the political situation in Greece was challenged by a commenter at his blog. Carol P Christ wrote with regards to the political and social responses to the crisis:

Since you are a member of the Progressive Left, you might reconsider calling Syriza the ‘far” Left in comparison to ‘far’ right Golden Dawn. There is no comparison between the 2. Syriza is a coaliton of parties to the left of centrist PASOk and to the “right” of KKE the Communist Party. You might be voting for them if you were in Greece, but you surely would NOT be voting for Golden Dawn. There is NO “comparison” between the 2. Continuing to compare the 2 parties makes it seem that all Greeks are irrational. There is nothing irrational about voting for Syriza. [..]

The “austerity” programs of the EU and banking systems have already destroyed our economy. To blame immigrants as Golden Dawn does is illogical. To ask voters to reject the terms of the second austerity package which is leading to massive unemployment and daily failures of small businesses is by no means irrational.

The Green Party is also against the austerity packages. And we are not “irrational” either.

The dualistic thinking of the west (ironically a legacy of Plato) leads to the demonization of the “other” as irrational. Unfortunately Greece has been portrayed as the “irrational” other within Europe for some time now.

Greece does need to change, but punishing the poor and middle classes is not a “rational” policy. [..]

Let me add that the European union and the Euro should not be confused. The Euro has only been in existence for 11 years. England with one of the largest economies in Europe is not a member of the Euro, nor is Sweden. They are still part of Europe and the European Union.

In Greece the Euro led to a massive rise in prices (a cup of coffee from $1 to $3-5, etc.) without a concomitant rise in wages. For example a tour bus driver makes E700 a month and a radiologist E1400, wages that are near poverty level in the US. depending on family size. Yet the cost of living is as high or higher than in the US, thanks to the price rises that the Euro brought. Gasoline is over $10 a gallon. Sales tax is 23%.

The European Union is a good thing, but the Euro was driven more by market forces and the desire to sell goods freely in Europe, than by a concern for world peace, the environmental protection, or any of the other good things the European Union is working on.

The Euro has not been a good thing for Greece, in my opinion.

(I have taken the liberty of posting most of Ms. Christ’s comments because I think they go straight to the heart of the misrepresentation that is taking place in the traditional news media.)

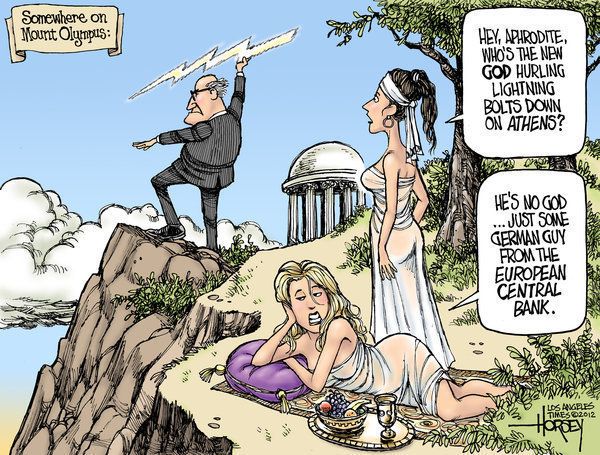

In another article at the New Economic Perspective, Prof. Black reports that the former head of the European Central Bank (ECB), Jean-Claude Trichet, thinks that by giving European politicians the power to declare a sovereign state bankrupt and take over its fiscal policy it would salvage the euro. To quote Prof. Black, “austerians have decided that since democracy is the problem, imperialism is the answer.”

Nor are fixing the problems of the euro a solution for the austerians:

Trichet, however, says that answer is impossible: “For the European Union, a fully fledged United States of Europe where nation states cede a large chunk of fiscal authority to the federal government appears politically unpalatable, Trichet said.” Democracy remains the stumbling block, but Trichet has an answer to that problem – crush democracy. He proposes that the EU:

“[T]ake a country into receivership when its political leaders or its parliament cannot implement sound budgetary policies approved by the EU. The action would have democratic accountability if it were approved by the European Council of EU heads of states and the elected European Parliament, he said.”

Of course, the “sound budgetary policies” he means are the suicidal, and failed policies of trying to balance the budget during a Great Recession. He does not understand even now that a nation in a severe recession cannot simply decide to run a budget surplus. It can try to do so, by cutting spending or raising taxes, but those policies are likely to reduce already sharply inadequate public and private sector demand, which increases unemployment, increases demand for public services, and reduces government revenue – all factors likely to increase the budget deficit. I am sure that the Greeks will consider the loss of their sovereignty at the hands of hostile foreign powers who openly sneer at the Greek people to represent the epitome of “democratic accountability.”

And what was the reaction of Berlin to Trichet’s policy to force suicidal austerity on the Greeks and bleed their economy while removing their sovereignty and right to democratic rule? You know the answer.

As Prof Black so aptly noted that that austerity is “a policy where you’re handed a gun and told to shoot yourself. Eventually people say, ‘Now exactly why should I do that?’. [..]

Whether Greece is the good or the bad, the policy is stupid.”

The United States is not Greece. It has its own sovereign currency and a bond market which it controls. We do not need to follow the EU and shoot ourselves with austerity.

The heads of state of the EuroZone countries met in Brussels today for a two day summit to try to come to an agreement on how to bail out two of its biggest members, Italy and Spain:

The heads of state of the EuroZone countries met in Brussels today for a two day summit to try to come to an agreement on how to bail out two of its biggest members, Italy and Spain:

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting. Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the  The French Presidential election will take place this Sunday, May 6. Meanwhile, the campaigning has ended Friday evening with the Socialist challenger,

The French Presidential election will take place this Sunday, May 6. Meanwhile, the campaigning has ended Friday evening with the Socialist challenger,

Recent Comments