Modern economic philosophy is generally considered to have started with Smith and Hobbes who were reacting against a system of monarchal merchantilism where favored courtiers were rewarded with monopolies in a planned economy enforced by a state claim of exclusive authority on violence.

Read that again because it’s important.

Their groundbreaking contribution was the concept that markets (individuals) could more efficiently allocate resources (capital) than corrupt cronyism. You know, free market capitalism.

Compare and contrast-

End of the Affair?

The Editors of The New York Times

Published: May 14, 2012

There has been less buying and selling of stock, and there have been huge outflows of investor dollars from domestic stock mutual funds, as detailed recently by The Times’s Nathaniel Popper. If the trend continues, the result could be a less robust market, with fewer companies opting to raise money by issuing shares and fewer investors willing to put their retirement savings into stocks.

…

Policy makers should pay attention. Evidence suggests that investors are not merely reacting to tough conditions, but rather are staying away because they do not trust the market. Restoring trust is crucial to restoring the market.American stocks have doubled in price since the market hit bottom three years ago. But trading in the United States stock market has not only failed to recover since the 2008 financial crash, it has continued to fall. In April, average daily trades stood at 6.5 billion, about half their peak four years ago. By comparison, after the market busts of 1987 and 2001, trading recovered within two years. In fact, going back to 1960, trading had never declined for three consecutive years, let alone four and counting.

Investors haven’t just hunkered down, they have headed for the exits. Since the start of 2008, domestic stock mutual funds, a common way for individuals to invest, were drained of more than $400 billion, compared with an inflow of $52 billion in the four years before that.

…

There is also the feeling that the market has become increasingly unfair to investors. For example, Mr. Popper also reported recently on rebates to brokers from stock exchanges. In general, brokers are required to find the best prices for clients who pay them to buy and sell shares. But with the nation’s 13 exchanges now paying brokers for sending them business, brokers may have an incentive to search for the biggest rebate rather than the best price. A new study has estimated that rebates could be costing mutual funds, pension funds and individual investors as much as $5 billion a year.Also known as “maker-taker” pricing, the rebates have caught the attention of market researchers and investor advocates, including two former economists for the Securities and Exchange Commission who issued a report in 2010 saying that “in other contexts, these payments would be recognized as illegal kickbacks.”

I realize citation of major media outlets is considered but a quaint remnant of irrelevant reality by sycophants and ‘bots, but I thought I’d draw this to your attention.

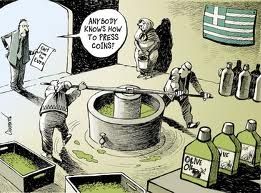

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Recent Comments