Strategy and tactics of guerrilla warfare tend to focus around the use of a small, mobile force competing against a large, unwieldy one. The guerrilla focuses on organising in small units, dependent on the support of the local population. Tactically, the guerrilla army attacks its enemy in small, repetitive attacks from the opponent’s center of gravity with a view to reducing casualties and becoming an intensive, repetitive strain on the enemy’s resources, forcing an over-eager response which will both anger their own supporters and increase support for the guerrilla, thus forcing the enemy to withdraw.

Fourteenth Edition of the Encyclopedia Britannica (1929)

This seemed unlike the ritual of war of which Foch had been priest, and so it seemed that there was a difference of kind. Foch called his modern war “absolute.” In it two nations professing incompatible philosophies set out to try them in the light of force. A struggle of two immaterial principles could only end when the supporters of one had no more means of resistance. An opinion can be argued with: a conviction is best shot. The logical end of a war of creeds is the final destruction of one, and Salammbo the classical textbook-instance. These were the lines of the struggle between France and Germany, but not, perhaps, between Germany and England, for all efforts to make the British soldier hate the enemy simply made him hate war. Thus the “absolute war” seemed only a variety of war; and beside it other sorts could be discerned, as Clausewitz had numbered them, personal wars for dynastic reasons, expulsive wars for party reasons, commercial wars for trading reasons.

Now the Arab aim was unmistakably geographical, to occupy all Arabic-speaking lands in Asia. In the doing of it Turks might be killed, yet “killing Turks” would never be an excuse or aim. If they would go quietly, the war would end. If not, they must be driven out: but at the cheapest possible price, since the Arabs were fighting for freedom, a pleasure only to be tasted by a man alive.

…

In the Arab case the algebraic factor would take first account of the area to be conquered. A casual calculation indicated perhaps 140,000 square miles. How would the Turks defend all that-no doubt by a trench line across the bottom, if the Arabs were an army attacking with banners displayed . . . but suppose they were an influence, a thing invulnerable, intangible, without front or back, drifting about like a gas? Armies were like plants, immobile as a whole, firm-rooted, and nourished through long stems to the head. The Arabs might be a vapour, blowing where they listed. … It seemed that the assets in this sphere were with the Arabs, and climate, railways, deserts, technical weapons could also be attached to their interests. The Turk was stupid and would believe that rebellion was absolute, like war, and deal with it on the analogy of absolute warfare.

…

The Arab army just then was equally chary of men and materials: of men because they being irregulars were not units, but individuals, and an individual casualty is like a pebble dropped in water: each may make only a brief hole, but rings of sorrow widen out from them. The Arab army could not afford casualties.

…

The Arab war should be a war of detachment: to contain the enemy by the silent threat of a vast unknown desert, not disclosing themselves till the moment of attack. This attack need be only nominal, directed not against his men, but against his materials: so it should not seek for his main strength or his weaknesses, but for his most accessible material.

…

The printing press is the greatest weapon in the armoury of the modern commander, and the commanders of the Arab army being amateurs in the art, began their war in the atmosphere of the 20th century, and thought of their weapons without prejudice, not distinguishing one from another socially. The regular officer has the tradition of 40 generations of serving soldiers behind him, and to him the old weapons are the most honoured. The Arab command had seldom to concern itself with what its men did, but much with what they thought, and to it the diathetic was more than half command. In Europe it was set a little aside and entrusted to men outside the General Staff. But the Arab army was so weak physically that it could not let the metaphysical weapon rust unused. It had won a province when the civilians in it had been taught to die for the ideal of freedom: the presence or absence of the enemy was a secondary matter.

…

The Turkish army was an accident, not a target. Our true strategic aim was to seek its weakest link, and bear only on that till time made the mass of it fall. The Arab army must impose the longest possible passive defence on the Turks (this being the most materially expensive form of war) by extending its own front to the maximum.

…

The contest was not physical, but moral, and so battles were a mistake. All that could be won in a battle was the ammunition the enemy fired off. … Battles are impositions on the side which believes itself weaker, made unavoidable either by lack of land-room, or by the need to defend a material property dearer than the lives of soldiers. The Arabs had nothing material to lose, so they were to defend nothing and to shoot nothing. Their cards were speed and time, not hitting power, and these gave them strategical rather than tactical strength.

…

The Desert and the Sea. In character these operations were like naval warfare, in their mobility, their ubiquity, their independence of bases and communications, in their ignoring of ground features, of strategic areas, of fixed directions, of fixed points. “He who commands the sea is at great liberty, and may take as much or as little of the war as he will” … The Arab army never tried to maintain or improve an advantage, but to move off and strike again somewhere else. It used the smallest force in the quickest time at the farthest place. To continue the action till the enemy had changed his dispositions to resist it would have been to break the spirit of the fundamental rule of denying him targets.

…

An Undisciplined Army. The internal economy of the raiding parties was equally curious. Maximum irregularity and articulation were the aims. Diversity threw the enemy intelligence off the track. By the regular organization in identical battalions and divisions information builds itself up, until the presence of a corps can be inferred on corpses from three companies. The Arabs, again, were serving a common ideal, without tribal emulation, and so could not hope for any esprit de corps. Soldiers are made a caste either by being given great pay and rewards in money, uniform or political privileges; or, as in England, by being made outcasts, cut off from the mass of their fellow-citizens. There have been many armies enlisted voluntarily: there have been few armies serving voluntarily under such trying conditions, for so long a war as the Arab revolt. Any of the Arabs could go home whenever the conviction failed him. Their only contract was honour.

Consequently the Arab army had no discipline, in the sense in which it is restrictive, submergent of individuality, the Lowest Common Denominator of men. In regular armies in peace it means the limit of energy attainable by everybody present: it is the hunt not of an average, but of an absolute, a 100-per-cent standard, in which the 99 stronger men are played down to the level of the worst. The aim is to render the unit a unit, and the man a type, in order that their effort shall be calculable, their collective output even in grain and in bulk. The deeper the discipline, the lower the individual efficiency, and the more sure the performance. It is a deliberate sacrifice of capacity in order to reduce the uncertain element. … In irregular war if two men are together one is being wasted. The moral strain of isolated action makes this simple form of war very hard on the individual soldier, and exacts from him special initiative, endurance and enthusiasm. Here the ideal was to make action a series of single combats to make the ranks a happy alliance of commanders-in-chief. The value of the Arab army depended entirely on quality, not on quantity. The members had to keep always cool, for the excitement of a blood-lust would impair their science, and their victory depended on a just use of speed, concealment, accuracy of fire. Guerrilla war is far more intellectual than a bayonet charge.

Here is the thesis:

Rebellion must have an unassailable base, something guarded not merely from attack, but from the fear of it: such a base as the Arab revolt had in the Red Sea ports, the desert, or in the minds of men converted to its creed. It must have a sophisticated alien enemy, in the form of a disciplined army of occupation too small to fulfill the doctrine of acreage: too few to adjust number to space, in order to dominate the whole area effectively from fortified posts.

It must have a friendly population, not actively friendly, but sympathetic to the point of not betraying rebel movements to the enemy.

Rebellions can be made by 2% active in a striking force, and 98% passively sympathetic. The few active rebels must have the qualities of speed and endurance, ubiquity and independence of arteries of supply. They must have the technical equipment to destroy or paralyze the enemy’s organized communications, for irregular war is fairly Willisen’s definition of strategy, “the study of communication,” in its extreme degree, of attack where the enemy is not.

In 50 words: Granted mobility, security (in the form of denying targets to the enemy), time, and doctrine (the idea to convert every subject to friendliness), victory will rest with the insurgents, for the algebraical factors are in the end decisive, and against them perfections of means and spirit struggle quite in vain.

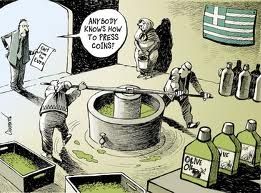

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Negotiations with party leaders to form a government in Greece fell apart again, as Greece inches closer to new elections in June that could usher in the left wing Socialist government opposed to the draconian austerity agreement with the European Central Bank, the International Monetary Fund and the Eurozone. Talks will resume on Tuesday but the

Recent Comments