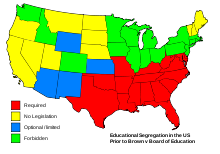

Brown v. Board of Education of Topeka, 347 U.S. 483 (1954), was a landmark decision of the United States Supreme Court that declared state laws establishing separate public schools for black and white students unconstitutional. The decision overturned the Plessy v. Ferguson decision of 1896 which allowed state-sponsored segregation. Handed down on May 17, 1954, the Warren Court’s unanimous (9-0) decision stated that “separate educational facilities are inherently unequal.” As a result, de jure racial segregation was ruled a violation of the Equal Protection Clause of the Fourteenth Amendment of the United States Constitution. This ruling paved the way for integration and the civil rights movement.

Supreme Court Review

The case of Brown v. Board of Education as heard before the Supreme Court combined five cases: Brown itself, Briggs v. Elliott (filed in South Carolina), Davis v. County School Board of Prince Edward County (filed in Virginia), Gebhart v. Belton (filed in Delaware), and Bolling v. Sharpe (filed in Washington D.C.).

All were NAACP-sponsored cases. The Davis case, the only case of the five originating from a student protest, began when sixteen-year-old Barbara Rose Johns organized and led a 450-student walkout of Moton High School.

The Kansas case was unique among the group in that there was no contention of gross inferiority of the segregated schools’ physical plant, curriculum, or staff. The district court found substantial equality as to all such factors. The Delaware case was unique in that the District Court judge in Gebhart ordered that the black students be admitted to the white high school due to the substantial harm of segregation and the differences that made the schools separate but not equal. The NAACP’s chief counsel, Thurgood Marshall, who was later appointed to the U.S. Supreme Court in 1967, argued the case before the Supreme Court for the plaintiffs. Assistant attorney general Paul Wilson, later distinguished emeritus professor of law at the University of Kansas, conducted the state’s ambivalent defense in his first appellate trial.

Unanimous Opinion and Key Holding

In spring 1953 the Court heard the case but was unable to decide the issue and asked to rehear the case in fall 1953, with special attention to whether the Fourteenth Amendment’s Equal Protection Clause prohibited the operation of separate public schools for whites and blacks.

The case was being reargued at the behest of Associate Justice Felix Frankfurter, who used re-argument as a stalling tactic, to allow the Court to gather a unanimous consensus around a Brown opinion that would outlaw segregation. Chief Justice Vinson had been a key stumbling block. The justices in support of desegregation spent much effort convincing those who initially dissented to join a unanimous opinion. Even though the legal effect would be same for a majority versus unanimous decision, it was felt that it was vital to not have a dissent which could be relied upon by opponents of desegregation as a legitimizing counterargument.

Conference notes and draft decisions illustrate the division of opinions before the decision was issued. Justices Douglas, Black, Burton, and Minton were predisposed to overturn Plessy. Fred M. Vinson noted that Congress had not issued desegregation legislation; Stanley F. Reed discussed incomplete cultural assimilation and states’ rights and was inclined to the view that segregation worked to the benefit of the African-American community; Tom C. Clark wrote that “we had led the states on to think segregation is OK and we should let them work it out.” Felix Frankfurter and Robert H. Jackson disapproved of segregation, but were also opposed to judicial activism and expressed concerns about the proposed decision’s enforceability. After Vinson died in September 1953, President Dwight D. Eisenhower appointed Earl Warren as Chief Justice. Warren had supported the integration of Mexican-American students in California school systems following Mendez v. Westminster.

While all but one justice personally rejected segregation, the self-restraint faction questioned whether the Constitution gave the Court the power to order its end. The activist faction believed the Fourteenth Amendment did give the necessary authority and were pushing to go ahead. Warren, who held only a recess appointment, held his tongue until the Senate, dominated by southerners, confirmed his appointment.

Warren convened a meeting of the justices, and presented to them the simple argument that the only reason to sustain segregation was an honest belief in the inferiority of Negroes. Warren further submitted that the Court must overrule Plessy to maintain its legitimacy as an institution of liberty, and it must do so unanimously to avoid massive Southern resistance. He began to build a unanimous opinion.

Although most justices were immediately convinced, Warren spent some time after this famous speech convincing everyone to sign onto the opinion. Justices Robert Jackson and Stanley Reed finally decided to drop their dissent to what was by then an opinion backed by all the others. The final decision was unanimous. Warren drafted the basic opinion and kept circulating and revising it until he had an opinion endorsed by all the members of the Court.

Holding

The key holding of the Court was that, even if segregated black and white schools were of equal quality in facilities and teachers, segregation by itself was harmful to black students and unconstitutional. They found that a significant psychological and social disadvantage was given to black children from the nature of segregation itself, drawing on research conducted by Kenneth Clark assisted by June Shagaloff. This aspect was vital because the question was not whether the schools were “equal”, which under Plessy they nominally should have been, but whether the doctrine of separate was constitutional. The justices answered with a strong “no”:

Does segregation of children in public schools solely on the basis of race, even though the physical facilities and other “tangible” factors may be equal, deprive the children of the minority group of equal educational opportunities? We believe that it does… Segregation of white and colored children in public schools has a detrimental effect upon the colored children. The impact is greater when it has the sanction of the law, for the policy of separating the races is usually interpreted as denoting the inferiority of the negro group. A sense of inferiority affects the motivation of a child to learn. Segregation with the sanction of law, therefore, has a tendency to [retard] the educational and mental development of negro children and to deprive them of some of the benefits they would receive in a racial[ly] integrated school system… We conclude that, in the field of public education, the doctrine of “separate but equal” has no place. Separate educational facilities are inherently unequal. Therefore, we hold that the plaintiffs and others similarly situated for whom the actions have been brought are, by reason of the segregation complained of, deprived of the equal protection of the laws guaranteed by the Fourteenth Amendment.

In New York City, U.S. District Judge Katherine Forrest ruled that the

In New York City, U.S. District Judge Katherine Forrest ruled that the

Recent Comments