(10 am. – promoted by ek hornbeck)

President Obama has done a brilliant job for the 1%.

Under Mr. Obama’s leadership, after a tremendous, near utter collapse of the economy brought about by a corrupt finance sector, trillions of public dollars have been poured into the coffers of bankers. One recent study showed that the big banks got an annual government subsidy of $83 billion dollars a year – equal to the amount of their alleged profits. Hold onto your hats, another recent study, by Chris Whalen and endorsed by noted economist Nouriel Roubini demonstrates that the subsidy is much larger, at least $780 billion dollars a year:

$360 billion in Federal Reserve subsidies, by creating an artificial “spread” in interest rates

$120 billion in federal deposit insurance (through the FDIC, backed by the Treasury)

At least $100 billion in government-guaranteed loans, especially mortgages

At least $100 billion in monopolistic advantages in the secondary market for home mortgages

More than $100 billion in fees in the over-the-counter (OTC) derivative market. (The lack of capital required in these transactions and other special dispensations from the Fed provide the zombie banks with unlimited leverage and almost no public scrutiny.)

The first study indicates that the too big to fail banks are barely breaking even and they are getting fat and demanding on our largesse; the second study indicates that they are indeed not profitable at all. They are nothing but corporate welfare queens with a large budget to purchase politicians.

Those purchases of politicians have really paid off, not a single banker has gone to jail for creating the catalyzing event of the, “great recession,” and those politicians are working hard for the banksters to prevent regulations from taking effect.

The headline news is that the big banks appear to be solvent again (at least as long as nobody pokes around too much); the banking sector is pretty much back to business as usual, with large profits and great pay and bonus packages for the bankers.

In fact, Wall Street bonuses are up as jobs decline:

One upside to downsizing on Wall Street: Cash bonuses jumped 9% to nearly $121,900 last year.

Total bonuses rose 8% to $20 billion, according to New York state Comptroller Thomas DiNapoli. That’s a reversal from 2011, when bonuses fell 19%, to a revised tally of $18.5 billion. …

Wall Street profits in 2012 didn’t just rebound — they tripled.

So while Wall Street is riding a wave of prosperity, the 99% who pay for their prosperity are getting screwed. Surprise!

101 Million Working Age Americans Do Not Have Jobs

The Obama administration and the legislators are bending over backwards to make sure that the 1% are flush with cash, but doing little or nothing for the working people:

The jobs recovery is a complete and total myth. The percentage of the working age population in the United States that had a job in March 2013 was exactly the same as it was all the way back in March 2010. … [T]here are now more than 101 million working age Americans that do not have a job. But even though the employment level in the United States has consistently remained very low over the past three years, the Obama administration keeps telling us that unemployment is actually going down.

In fact, they tell us that the unemployment rate has declined from a peak of 10.0% all the way down to 7.6%. And they tell us that in March the unemployment rate fell by 0.1% even though only 88,000 jobs were added to the U.S. economy. But it takes at least 125,000 new jobs a month just to keep up with population growth. So how in the world are they coming up with these numbers? Well, the reality is that the entire decline in the unemployment rate over the past three years can be accounted for by the reduction in size of the labor force.

In other words, the Obama administration is getting unemployment to go down by pretending that millions upon millions of unemployed Americans simply do not want jobs anymore.

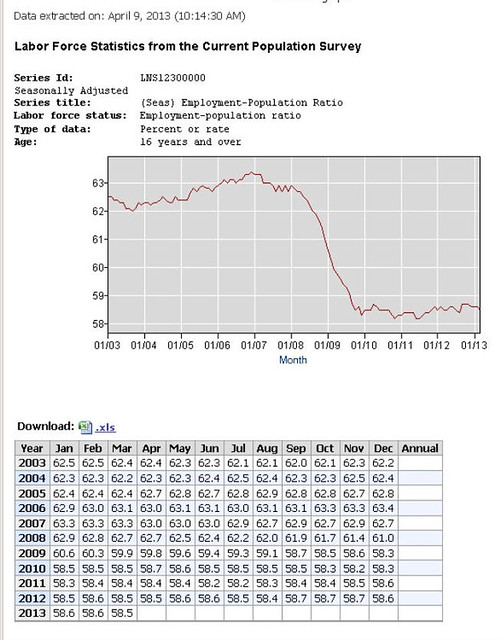

Anyone who can read a chart or a graph can see that actual unemployment has remained quite stable during Mr. Obama’s presidency:

Obama’s Brilliant Plans Benefit 1% Handsomely

So, it’s apparent where President Obama’s actions have been aimed. The corporate sector is awash in profits, Wall Street is going great guns and the working people get only lip service from this administration.

Even the efforts that have appeared to be aimed at helping the working people seem to turn out to be a bonanza for the corporations and Wall Street. President Obama’s banner achievement, “Obamacare,” turns out to be more of a subsidy for the insurance industry than a means to get more people healthcare. Working people will get more paperwork however, perhaps the unemployed and poor can heat their homes with it now that Obama’s budget proposes cutting LIHEAP heating subsidies this winter.

Speaking of President Obama’s budget, it appears that Obama’s quite happy to keep the economy not producing jobs:

The economy created just 88,000 jobs in March, down from close to 200,000 in other recent months, for one main reason: The January 2 budget deal and the March 1 sequester that hiked taxes on working people and cut public spending.

In the January deal, payroll taxes on working people were raised by some $120 billion. The more highly publicized tax hike on the top one percent raised less than $65 billion. The sequester added another $85 billion of budget cuts. The combined economic contraction will be about $270 billion this year, and according to the Congressional Budget Office the result will be to cut economic growth roughly in half.

But the deal that Obama is trying to coax the Republicans into accepting would cut the budget at this rate for an entire decade. The economics are just insane. There is no evidence that banks are waiting to lower interest rates (which are already rock bottom) or businesses waiting to invest, pending progress on a grand budget bargain. Businesses are hesitating to invest because customers don’t have money in their pockets — and a deflationary budget deal will only make the economy worse.

Guess who stands to profit handsomely from President Obama’s austerity measures:

The poor and middle classes have shouldered by far the heaviest burdens of the global political obsession with austerity policies over the past three years. In the United States, budget cuts have forced states to reduce education, public transportation, affordable housing and other social services. In Europe, welfare cuts have driven some severely disabled individuals to fear for their lives.

But the austerity game also has winners. Cutting or eliminating government programs that benefit the less advantaged has long been an ideological goal of conservatives. Doing so also generates a tidy windfall for the corporate class, as government services are privatized and savings from austerity pay for tax cuts for the wealthiest citizens.

U.S. financial interests that stand to gain from Medicare, Medicaid and Social Security cutbacks “have been the core of the big con,” the “propaganda,” that those programs are in crisis and must be slashed, said James Galbraith, an economist at the University of Texas.

So, President Obama has worked assiduously to cater to the interests of the 1%, has done little for the 99% and appears to be poised to screw the working people of America even more thoroughly in his most recent budget.

Could it get any worse? Yes, sadly, it could.

1% rob working people with their banks, Obama prepares getaway car

For those who have been paying attention to the debacle in Cyprus, where regular bank depositors assets were seized by the Cypriot government to “bail-in,” their big banks, you might have noticed a statement by an accidentally honest, inexperienced bureacrat that this action was a template for future actions to resolve debt crises. The statement was quickly walked back by the EU bureacracy.

Unfortunately, it turns out that there was considerable truth in that bureaucrat’s statement as there are plans that have been formulated to seize the holdings of depositors when big banks fail:

Shock waves went around the world when the IMF, the EU, and the ECB not only approved but mandated the confiscation of depositor funds to “bail in” two bankrupt banks in Cyprus. A “bail in” is a quantum leap beyond a “bail out.” When governments are no longer willing to use taxpayer money to bail out banks that have gambled away their capital, the banks are now being instructed to “recapitalize” themselves by confiscating the funds of their creditors, turning debt into equity, or stock; and the “creditors” include the depositors who put their money in the bank thinking it was a secure place to store their savings.

The Cyprus bail-in was not a one-off emergency measure but was consistent with similar policies already in the works for the US, UK, EU, Canada, New Zealand, and Australia

So if the big banks make bad bets on derivatives again, who gets stuck with the bill? Erm, it appears that the 1% have bought themselves another law:

Under both the Dodd Frank Act and the 2005 Bankruptcy Act, derivative claims have super-priority over all other claims, secured and unsecured, insured and uninsured. In a major derivatives fiasco, derivative claimants could well grab all the collateral, leaving other claimants, public and private, holding the bag. …

It used to be that the government would backstop the FDIC if it ran out of money. But section 716 of the Dodd Frank Act now precludes the payment of further taxpayer funds to bail out a bank from a bad derivatives gamble.

Obama’s FDIC has made plans for this in the United States. The plan has some quite eye-opening features:

Although few depositors realize it, legally the bank owns the depositor’s funds as soon as they are put in the bank. Our money becomes the bank’s, and we become unsecured creditors holding IOUs or promises to pay. … But until now the bank has been obligated to pay the money back on demand in the form of cash. Under the FDIC-BOE plan, our IOUs will be converted into “bank equity.” The bank will get the money and we will get stock in the bank. With any luck we may be able to sell the stock to someone else, but when and at what price? Most people keep a deposit account so they can have ready cash to pay the bills. …

No exception is indicated for “insured deposits” in the U.S., meaning those under $250,000, the deposits we thought were protected by FDIC insurance. This can hardly be an oversight, since it is the FDIC that is issuing the directive. …

If our IOUs are converted to bank stock, they will no longer be subject to insurance protection but will be “at risk” and vulnerable to being wiped out, just as the Lehman Brothers shareholders were in 2008. …

An FDIC confiscation of deposits to recapitalize the banks is far different from a simple tax on taxpayers to pay government expenses. The government’s debt is at least arguably the people’s debt, since the government is there to provide services for the people. But when the banks get into trouble with their derivative schemes, they are not serving depositors, who are not getting a cut of the profits. Taking depositor funds is simply theft.

So the next time the 1% rob us with their banks, President Obama has prepared the getaway car, put it in place and has the motor running.

Can we raise some hell now?

1 comments

Author

thanks for reading!