Now That’s Rich

By PAUL KRUGMAN, The New York Times

Published: August 22, 2010

We need to pinch pennies these days. Don’t you know we have a budget deficit? For months that has been the word from Republicans and conservative Democrats, who have rejected every suggestion that we do more to avoid deep cuts in public services and help the ailing economy.

But these same politicians are eager to cut checks averaging $3 million each to the richest 120,000 people in the country.

What – you haven’t heard about this proposal? Actually, you have: I’m talking about demands that we make all of the Bush tax cuts, not just those for the middle class, permanent.

…

And where would this $680 billion go? Nearly all of it would go to the richest 1 percent of Americans, people with incomes of more than $500,000 a year. But that’s the least of it: the policy center’s estimates say that the majority of the tax cuts would go to the richest one-tenth of 1 percent. … And the average tax break for those lucky few – the poorest members of the group have annual incomes of more than $2 million, and the average member makes more than $7 million a year – would be $3 million over the course of the next decade.

In Striking Shift, Small Investors Flee Stock Market

By GRAHAM BOWLEY, The New York Times

Published: August 21, 2010

One of the phenomena of the last several decades has been the rise of the individual investor. As Americans have become more responsible for their own retirement, they have poured money into stocks with such faith that half of the country’s households now own shares directly or through mutual funds, which are by far the most popular way Americans invest in stocks. So the turnabout is striking.

…

The notion that stocks tend to be safe and profitable investments over time seems to have been dented in much the same way that a decline in home values and in job stability the last few years has altered Americans’ sense of financial security.

…

But then came a grim reassessment of America’s economic prospects as unemployment remained stubbornly high and private sector job growth refused to take off.

Investors’ nerves were also frayed by the “flash crash” on May 6, when the Dow Jones industrial index fell 600 points in a matter of minutes. The authorities still do not know why.

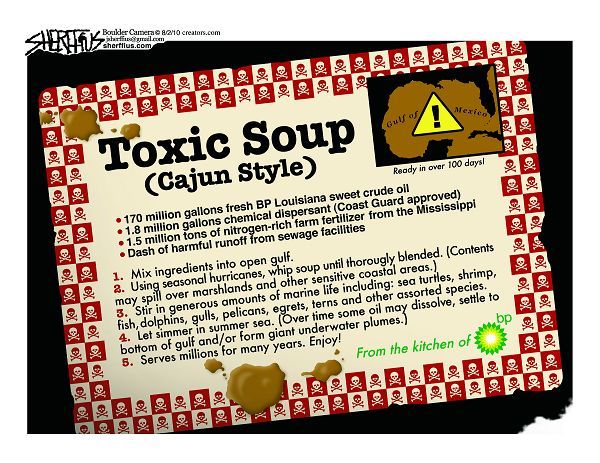

Special BP Blowout Disaster Coverage

1 Gulf claims chief says no-sue rule was his idea

By HARRY R. WEBER, Associated Press Writer

Sun Aug 22, 4:09 pm ET

| NEW ORLEANS – The new administrator for damage claims from Gulf oil spill victims said Sunday it was his idea, not BP’s, to require that anyone who receives a final settlement from the $20 billion compensation fund give up the right to sue the oil giant.

But Ken Feinberg told reporters that he has not yet decided whether the no-sue requirement will extend to other companies that may be responsible for the worst offshore oil spill in U.S. history.

He insisted that payouts from the claims facility he will run will be more generous than those from any court. Feinberg also ran the government compensation fund created after the 9/11 attacks, and there was a similar no-sue provision. |

2 For Gulf tourism, problem is perception – not oil

By NOAKI SCHWARTZ, Associated Press Writer

Sun Aug 22, 1:51 pm ET

| BILOXI, Miss. – On the great yawning porch that once belonged to Confederate president Jefferson Davis, two women sit in rockers listening to the cicadas and looking out over Mississippi Sound as they wait for their tour to begin.

Before Hurricane Katrina, some 200 people came each day to visit the house – the only structure on the oak-shaded Beauvoir estate not destroyed by the storm. And that’s just what’s needed to break even. Tourism has dropped off 20 percent here, with just a few visitors on some days since BP PLC’s well blew out in the Gulf of Mexico.

The story here is mirrored across the Gulf Coast. Beaches have been cleaned of crude, the leak has been plugged and some cities never had oil wash ashore at all. Still, tourists stay away from what they fear are oil-coated coastlines – a perception officials say could take years to overcome and cost the region billions of dollars. |

Outrageous? We report…

Recent Comments