Monday Business Edition

As Krugman points out–

When historians look back at 2008-10, what will puzzle them most, I believe, is the strange triumph of failed ideas. Free-market fundamentalists have been wrong about everything – yet they now dominate the political scene more thoroughly than ever.

…

(T)he fact is that the Obama stimulus – which itself was almost 40 percent tax cuts – was far too cautious to turn the economy around. And that’s not 20-20 hindsight: many economists, myself included, warned from the beginning that the plan was grossly inadequate. Put it this way: A policy under which government employment actually fell, under which government spending on goods and services grew more slowly than during the Bush years, hardly constitutes a test of Keynesian economics.

…

(E)verything the right said about why Obamanomics would fail was wrong. For two years we’ve been warned that government borrowing would send interest rates sky-high; in fact, rates have fluctuated with optimism or pessimism about recovery, but stayed consistently low by historical standards. For two years we’ve been warned that inflation, even hyperinflation, was just around the corner; instead, disinflation has continued, with core inflation – which excludes volatile food and energy prices – now at a half-century low.

And while it is true that Republicans are trying to write certain false narratives–

(T)he modern Republican Party is utterly dedicated to the Reaganite slogan that government is always the problem, never the solution. And, therefore, we should have realized that party loyalists, confronted with facts that don’t fit the slogan, would adjust the facts.

…

It’s not as if the story of the crisis is particularly obscure. First, there was a widely spread housing bubble, not just in the United States, but in Ireland, Spain, and other countries as well. This bubble was inflated by irresponsible lending, made possible both by bank deregulation and the failure to extend regulation to “shadow banks,” which weren’t covered by traditional regulation but nonetheless engaged in banking activities and created bank-type risks.

Then the bubble burst, with hugely disruptive consequences. It turned out that Wall Street had created a web of interconnection nobody understood, so that the failure of Lehman Brothers, a medium-size investment bank, could threaten to take down the whole world financial system.

It’s a straightforward story, but a story that the Republican members of the commission don’t want told. Literally.

Last week, reports Shahien Nasiripour of The Huffington Post, all four Republicans on the commission voted to exclude the following terms from the report: “deregulation,” “shadow banking,” “interconnection,” and, yes, “Wall Street.”

…

That report is all of nine pages long, with few facts and hardly any numbers. Beyond that, it tells a story that has been widely and repeatedly debunked – without responding at all to the debunkers.

In the world according to the G.O.P. commissioners, it’s all the fault of government do-gooders, who used various levers – especially Fannie Mae and Freddie Mac, the government-sponsored loan-guarantee agencies – to promote loans to low-income borrowers. Wall Street – I mean, the private sector – erred only to the extent that it got suckered into going along with this government-created bubble.

Shahien Nasiripour–

During a private commission meeting last week, all four Republicans voted in favor of banning the phrases “Wall Street” and “shadow banking” and the words “interconnection” and “deregulation” from the panel’s final report, according to a person familiar with the matter and confirmed by Brooksley E. Born, one of the six commissioners who voted against the proposal.

…

The shadow banking system refers to the part of the financial system in which investors and other nonbanks like hedge funds and investment firms provide credit to borrowers, as opposed to more traditional banks. Interconnection refers to the links that bind financial institutions to one another, like derivatives, borrowings, and investments.

They’re not the only ones.

Neo-Liberal economics, especially of the Trickle Down Voodoo Variety (call a spade a spade Paul) is a complete, abject failure.

Coming from Republicans or Democrats.

It’s hard for me to fathom how these people can claim Economics is even a “Social” Science when their theories so blatantly violate the first law of Scientific Inquiry- Your Results Shall Be Testable AND Duplicatable.

The Stimulus That Isn’t

By Robert Kuttner, The Huffington Post

Posted: December 19, 2010 07:41 PM

It is astonishing how the Beltway echo-chamber, most egregiously the editorial page and news columns of the Washington Post (hard to tell the difference), thinks this deal is good for the Republic. The Post has become a cheerleader for policies that fail to cure the economy and show off Obama as a weakling waiting to be rolled again.

The tax deal, re-branded as a stimulus program, is paltry and ineffective as economic tonic. What hardly anyone seems to have grasped is that the deal basically continues the status quo with almost no stimulus.

If the tax rates on the books in 2010 did not produce a recovery, why should we expect that the very same rates will change the economy in 2011?

Business News below.

Roger Shuler is a former journalist who, according to his bio at OpEdNews lives in Birmingham, Alabama, and works in ‘higher education’.

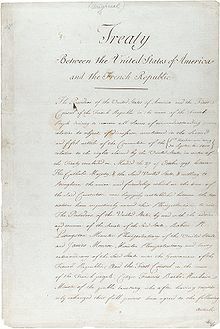

On this day in 1803,

On this day in 1803,

Recent Comments