It’s actually much simpler than you would think, China being very thinned skinned about criticism of its leaders and policies. The host of HBO’s “Last week Tonight” John Oliver did it in twenty minutes. How exactly did he achieve that, you ask? Simple, he compared China’s President Xi Jinping to that honey loving cartoon bear …

Tag: China

May 15 2018

Cool On China Trade

Trade sanctions are only for us not for Trump, Trump Orders Help For Chinese Phone-Maker After China Approves Money For Trump Project A mere 72 hours after the Chinese government agreed to put a half-billion dollars into an Indonesian project that will personally enrich Donald Trump, the president ordered a bailout for a Chinese-government-owned cellphone …

Apr 25 2018

Syria, Sanctions and Tariffs

We are aware that Donald Trump does not take advice from anyone in his cabinet or inner circle. But when it comes to sanctions, tariffs and red lines, it appears he takes his cues from Russian president Vladimir Putin, Fox & Friends and the voices in his head. When Trump tweeted that he was going …

Oct 09 2016

Sunday Train: Going to Tianjin by Subway and High Speed Rail

OK, so after years of (off and on) writing about High Speed Rail, I’ve finally been on a High Speed Rail train … on the Beijing – Tianjin Intercity Railway. Though I have to say that I went to Tianjin by Subway and High Speed Rail, given that substantially more time was spent en-route on …

Dec 07 2015

The Guantanamo 22

How a group of men from China’s Uighur community were sold in Afghanistan and imprisoned in Guantanamo as terrorists. China’s western autonomous region of Xinjiang is home to the country’s mostly Muslim Uighur minority. But many have fled China in recent years to escape persecution from Chinese authorities who have banned some of their cultural …

May 25 2015

US Terrorizes China; China Pulls the Golden Trigger.

All week I’ve been seeing references to this headline:

“China could announce that it holds 30,000 tons of gold to back the Yuan/Renminbi.”

As a Forex trader, the story took me by surprise, even though China has been stockpiling for years, and is the world’s largest gold producer. Also, it’s not like China to pull this trigger so fast. However, in the South China Sea last week, the US started militarily terrorizing China with war ships and fighter jets – and China warned (in so many polite words) that the US planted the seeds of its own doom.

So, maybe that’s what this is all about.

Nov 15 2013

The China Connection and Other Travails of a TBTF Bank

JP Morgan Chase is once again under investigation by the Department of Justice. This time for possibly bribing the daughter of the Chinese prime minister with a lucrative business deal to gain preferential treatment on the Chinese markets.

To promote its standing in China, JPMorgan Chase turned to a seemingly obscure consulting firm run by a 32-year-old executive named Lily Chang.

Ms. Chang’s firm, which received a $75,000-a-month contract from JPMorgan, appeared to have only two employees. And on the surface, Ms. Chang lacked the influence and public name recognition needed to unlock business for the bank.

But what was known to JPMorgan executives in Hong Kong, and some executives at other major companies, was that “Lily Chang” was not her real name. It was an alias for Wen Ruchun, the only daughter of Wen Jiabao, who at the time was China’s prime minister, with oversight of the economy and its financial institutions.

While the bank emerged from the financial crisis stronger than it ever was, Moody’s Investors Service cut its ratings of the JPMC and three other banks after deciding the government would be less likely to help them repay creditors in a crisis. JPMorgan was cut to A3 from A2. According to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority, the yield on JPMorgan’s $2 billion of 3.375 percent subordinated notes due May 2023 slipped 10 basis points to 4.3 percent.

Moody’s said that there was less likelihood of a widespread bailout of banks by the United States government as there was during the financial crisis five years ago and that bank debt holders would be forced to shoulder more of the losses in the future.

But the rating agency said it expected banks would be required by regulators in the United States to hold a higher level of capital, which was likely to result in higher recoveries for creditors in any future bank default. [..]

Under the Dodd-Frank Act, the Federal Reserve has been limited in its ability to provide taxpayer money to individual banks, and failing banks would be wound down in a so-called orderly liquidation, in which creditors would bear the bulk of the burden of the losses.

However, some critics have expressed doubts that regulators could handle the liquidation of one or more of the nation’s largest banks in a severe financial crisis.

In the midst of this, somebody at JPMC thought it would be a great idea to hold a Twitter Q&A with the public using the hashtag #AskJPM. The results were extremely amusing but a major PR #FAIL for the bank. Award winning actor Stacy Keech, the voice of American Greed, reads some of the best tweets verbatim.

If you’re a poet and good at writing haiku, Rolling Stone‘s contributing editor Matt Taibbi is offering a Jaime Dimon tee shirt for the best “J.P. Morgan Chase Q&A Fiasco” haiku. Matt will announce the winner Monday.

Feb 01 2011

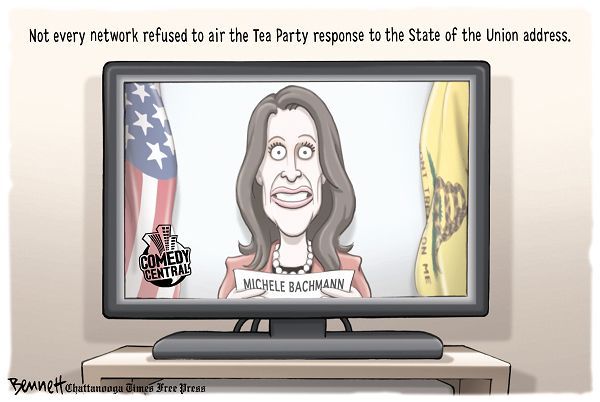

The Week in Editorial Cartoons – Comedy Central Presents… Michele Bachmann

Crossposted at Daily Kos and Docudharma

|

|

|

|

Aug 19 2010

No Afghanistan Withdrawal in 2011 – Engdahl: “US will Expand War”

“The commander of U.S. and NATO forces in Afghanistan says he is not bound by the July 2011 date set for a troop pull-out. General David Petraeus said he could well advise President Obama not to go ahead if he believes it’s the wrong time. American public support for the war is at an all-time low, with July being the deadliest month for U.S. and NATO troops since 2001. With frustration growing about the occupation of Afghanistan, politicians in Germany have even suggested talking to the Taliban and terrorist organizations to avoid a further escalation of violence.”

RT talks with political economist and author F William Engdahl, author of “A Century of War: Anglo-American Oil Politics and the New World Order” and “Full Spectrum Dominance”, about his thoughts on the Afghanistan occupation and the 30 year war scenario to prevent the independent economic development of Russia, China, and the Shanghai Cooperation Organisation (SCO) states. Engdhahl has written on issues of energy, politics and economics for more than 30 years, beginning with the first oil shock in the early 1970s. Based in Germany, Engdahl contributes regularly to a number of publications including Asia Times Online, Asia, Inc, Japan’s Nihon Keizai Shimbun, Foresight magazine; Freitag and ZeitFragen newspapers in Germany and Switzerland respectively.

RussiaToday | August 16, 2010

Recent Comments