It’s very strange that governments knowing that austerity is just deepening the recession in Europe, they continue down the same path.

UK GDP fell faster than previously estimated in fourth quarter, ONS says

• UK GDP fell 0.3% rather than 0.2% in fourth quarter

• Economists had expected no change

• Disposable incomes fall 1.2% – worst since 1977

Britain’s economy was even weaker than expected at the end of last year, underlining the country’s struggle to avoid another recession. [..]

The signs from business surveys and much of the official data so far for this first quarter have been taken as evidence of at least a small new-year bounce-back. But there are widespread doubts over whether that can be sustained. Economists cite many headwinds facing the UK economy, including high oil prices, a government austerity drive and the sovereign debt crisis in the eurozone. [..]

Government spending, exports and household consumption grew, but economists warned that pattern had little chance of holding up.

“The government purse strings are being tightened, growth is deteriorating in key export markets, with the eurozone now likely to be in another recession, and revised retail sales data have signalled a far weaker start to the year than previously thought, raising concerns that households are continuing to retrench amid worries about the economy, jobs and rising prices,” said Chris Williamson, chief economist at Markit.

So what did the Cameron government do? If you guessed double down on austerity, you’re right. Jonathan Portes analogy with Shakespeare’s Macbeth is quite apt:

I described this as the “Macbeth argument”, from the following quote:

“I am in blood stepped in so far that should I wade no more, Returning were as tedious as go o’er.” [Act III, scene iv.]

In other words, since Macbeth has already killed Duncan and Banquo, it is better to carry on (and order the deaths of Macduff and his family) than to stop. So, although misguided policy has led to unnecessary economic damage, that damage is (returning to economist speak) a sunk cost; and the pain ahead is less then the pain that we would suffer if we changed course, as a consequence of the possible negative financial market reaction.

The Treasury also appears to subscribe to a variant of this argument. When the original fiscal consolidation plan was welcomed by the rating agencies, that was a vote of confidence:

“Standard & Poor’s, the ratings agency, revised its outlook on Britain from negative to stable..The Chancellor said: “”That is .. a vote of confidence in the Coalition Government’s economic policies..” Telegraph, 26 October 2010

But when the same rating agencies realised the damage the plan was doing to growth, that made it even more necessary:

“Fitch revised the outlook on the UK’s rating to negative from stable….”A week from the Budget this is a reminder of why it is essential Britain sticks to its plans to deal with its debts,” a Treasury spokesman said…” Telegraph, 14 March 2012

Spain has already fallen into another recession, sucked in by the black hole of austerity:

Spain’s economy is suffering its second recession since 2009, the Bank of Spain said, a development that obstructs the government’s efforts to reorder public finances as it prepares the budget for this year.

“The most recent information for the start of 2012 confirms the prolongation of the contraction in output,” the Madrid-based central bank said in its monthly bulletin today.

Spain’s gross domestic product declined 0.3 percent in the fourth quarter of last year, less than two years after emerging from the last recession. Prime Minister Mariano Rajoy will present his 2012 budget on March 30, amid growing pressure from investors and European peers to rein in the deficit, which was 8.5 percent of GDP last year.

The spending plan, his first since coming to power in December, won’t increase tax on consumption nor cut civil servants’ salaries, Rajoy said today in Seoul. The previous administration slashed wages of public workers by an average 5 percent in 2010.

Rajoy, who leads the pro-business People’s Party, hasn’t said where he will cut spending, even as he pledged today to present a budget that is “very austere.”

And just as with Britain and Greece, the same causes are exacerbating the Spanish problem, from Delusional Economics at naked capitalism:

Back in November last year I posted on my confusion over the jubilation shown by the citizens of Spain as they elected Mariano Rajoy as their new political leader. Mr Rajoy’s strategy during the election campaign was to say very little about what he was actually intending to do to address his country’s financial problems, preferring to simply let the incumbent party fall on its own sword so that he could take the reins. It became obvious soon after the election that, despite his party’s best efforts to dodge questions, the intention was simply to continue with even more austerity.

Since that post I have continually warned that although Spain is obviously a different country to Greece in regards to how its problems have manifested, it still faces significant macroeconomic challenges that were not being correctly reflected in the bond market. [..]

And in the United States, conservative state governments continue with their austerity agenda that continues to be a drag on the economy:

Republicans seized control of both branches of the legislature in 11 states after the 2010 elections. It’s in these very states that public sector layoffs are disproportionately concentrated, leading to one of the biggest rounds of job losses for the public workforce since record keeping began. Governors and state legislators promised to focus on creating jobs and balancing budgets during campaign season-even newly elected Pennsylvania Governor Tom Corbett still claims that creating jobs is one of his “top priorities.” Instead, these newly Republican states are targeting public workers, causing a significant drop in employment in the public sector that has threatened the entire economy. [..]

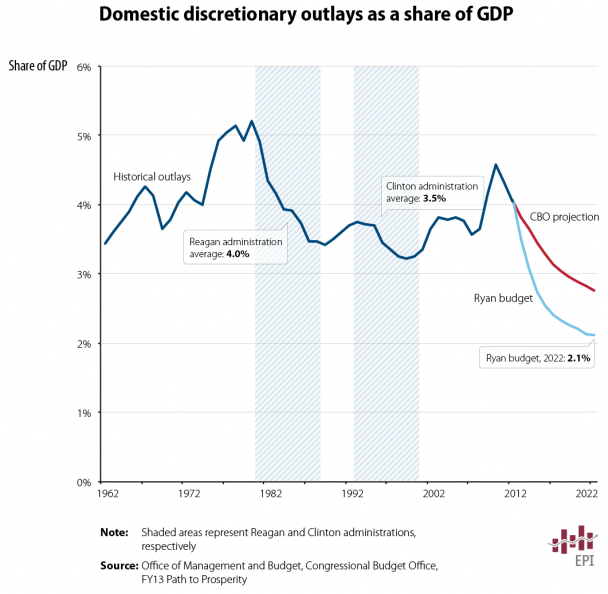

Economists argue over how significantly public sector layoffs in a weak economy hurt the recovery, but many agree that it has a substantial impact. Paul Krugman has estimated that if the government workforce had grown at a Reagan-era rate instead of decreasing rapidly, unemployment would now be closer to 7 percent, instead of the 8.5 percent it’s been hovering around for the past five months.

Growth in public employment would have three positive effects on the economy:

1. It would increase spending in the private sector, thus improving the GDP;

2. It would increase tax revenues to not just the federal government with increased collection of payroll tax, but also increase the tax revenues of both state and local governments.

3. Increased spending by would have a positive effect on employment in the private sector with a need for workers to meet the demand for goods and services.

Don’t try to tell this to economic conservatives because there is more blood to be spilled. No matter how much they wash, the stain of recession remains in the hands of conservative governments in Europe and the US.

Recent Comments